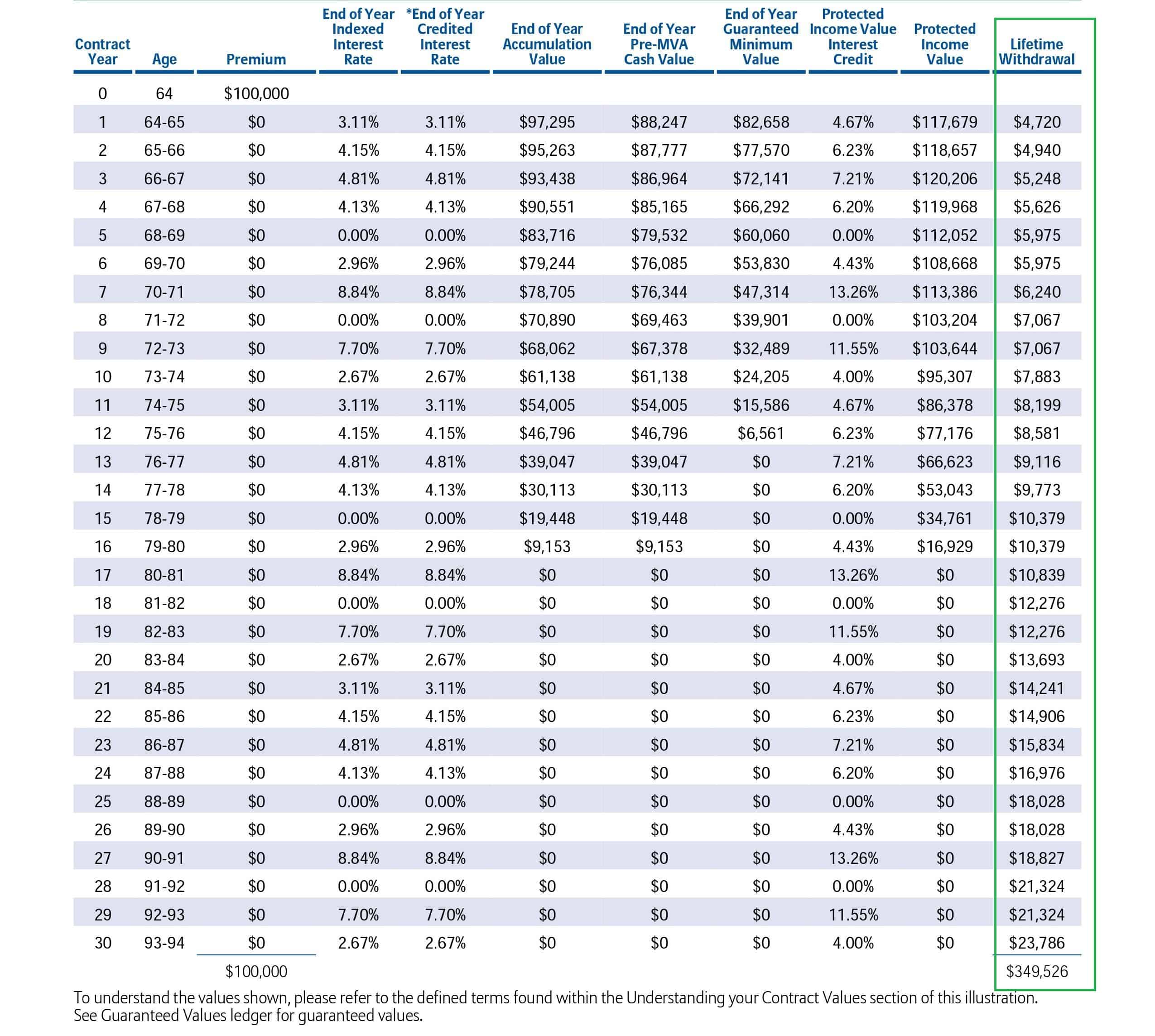

One of the main advantages of an annuity is that it can provide a stream of income that you cannot outlive. This material is for informational or educational purposes only and does not constitute investment advice under ERISA a securities.

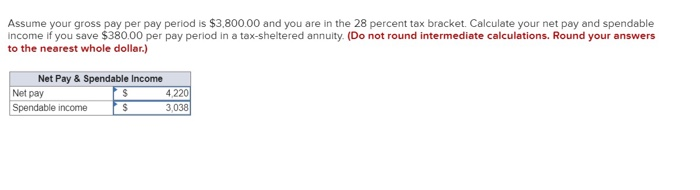

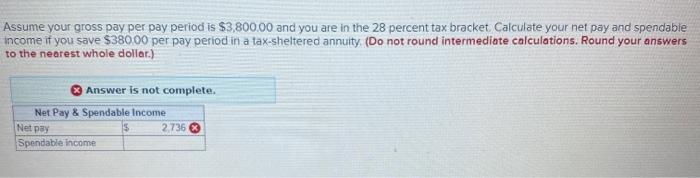

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

The exclusion ratio is a percentage that represents the portion of an annuity payment that is excluded from gross income and therefore not subject to ordinary.

. An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per month. IRC 403 b Tax-Sheltered Annuity Plans. Divide Cost Basis By Accumulation Value Multiply Monthly Payout By Exclusion Ratio Subtract Tax-Free Portion Step 1.

A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. In this publication you will find information to help you do the. Understanding a Tax-Sheltered Annuity.

With this calculator you can find several things. Sign Up for Free Tools in Seconds. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. UEI 403b Tax Sheltered Annuity Plan for eligible UEI employees. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

Per IRS Publication 571 Tax-Sheltered Annuity Plans 403 b Plans page 4. We Offer Innovative Products For Retirement That Help You Keep Your Plans. Ad Learn More about How Annuities Work from Fidelity.

Ad A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. A 403b is a type of tax sheltered annuity plan which allows you to invest pretax earnings in a retirement account and allow those funds to grow tax-free as well. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities.

If you withdraw money from your. A Tax Sheltered Annuity can also be described as a 403b. You are only taxed on the.

A Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment. Planning horizon years of distribution 1 to 40 Desired after-tax annual income during distribution todays Annual increase on distributions to account for inflation 0 to. Tax Sheltered Annuity TSA Contribution Limit Formula Please click a link below for the year you would like to calculate contributions.

Ad Learn More about How Annuities Work from Fidelity. This plan provides employees of certain nonprofit and public. The payment that would deplete the fund.

Fixed Annuity Calculator A Fixed Annuity can provide a very secure tax-deferred investment. Ad Our Income Annuity Calculator Can Help You Plan For The Future. Employees should also refer to University.

Ad Build Manage Forecast your Retirement Plan in One Convenient Location. Easy Personalized Money Management. A tax-sheltered annuity plan gives employees.

The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Learn More on AARP. When the 403b was created in 1958 it was known as a tax-sheltered annuity as it only offered annuities.

Find the sum of all. In the US one specific tax-sheltered annuity is the 403b plan. A 403b plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and.

As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public. Determine Cost Basis Determine your cost basis. 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011.

This publication can help you better understand the tax rules that apply to your 403 b tax-sheltered annuity plan. These Tools are Educational. The enclosed is information about the University Enterprises Inc.

An annuity is an investment that provides a series of payments in exchange for an initial lump sum. Ad This guide may help you avoid regret from making certain financial decisions. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

The payments can be made for a specific number of years or the rest of your life. If you are a chaplain and your employer doesnt exclude contributions made to your 403 b account from. Tax Sheltered Annuity Contributions.

It is also known as a 403 b retirement plan and. The terms tax-sheltered annuity and 403b are often used interchangeably. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they.

The Tax Sheltered Annuity Tsa 403 B Plan

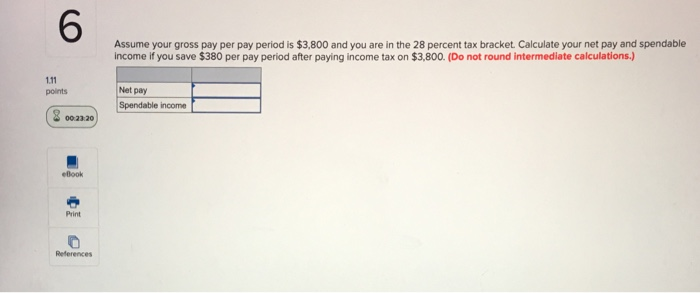

Solved 6 Assume Your Gross Pay Per Pay Period Is 3 800 And Chegg Com

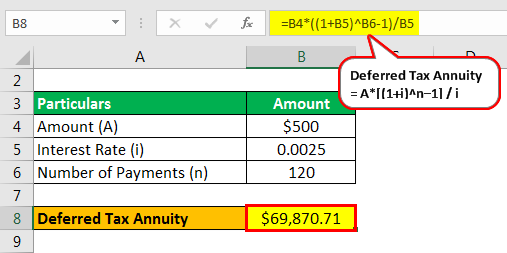

Tax Deferred Annuity Definition Formula Examples With Calculations

What Is An Inflation Protected Annuity And How Does It Work 2022

Tax Deferred Annuity Definition Formula Examples With Calculations

Annuity Taxation How Are Annuities Taxed

The Best Annuity Calculator 17 Retirement Planning Tools

The Best Annuity Calculator 17 Retirement Planning Tools

Tax Deferred Annuity Definition Formula Examples With Calculations

Annuity Taxation How Various Annuities Are Taxed

Annuity Calculator 401 K Plans Iras And Annuities Mathematics For The Liberal Arts Corequisite

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

Obamacare Investment Tax Problem For High Income Earners

The Best Annuity Calculator 17 Retirement Planning Tools

What You Should Know About Tax Sheltered Annuities The Motley Fool

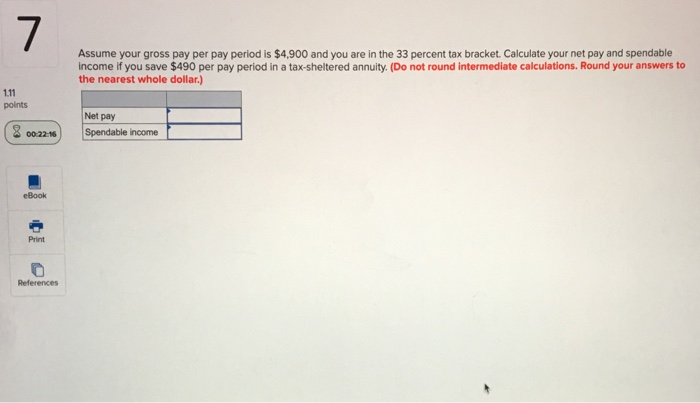

Solved Assume Your Gross Pay Per Pay Period Is 4 900 And Chegg Com